BlackRock has given Coinbase a strong endorsement of its ability to offer bitcoin trading to institutional clients. This deal will bring bitcoin trading to institutions of the largest asset manager in the world. Blackrock had $8.5 trillion under management as of the end to the second quarter 2022.

The struggling cryptocurrency exchange has announced today it will offer trading services for bitcoin to certain BlackRock clients. The partnership will link BlackRock’s proprietary investment software Aladdin to Coinbase Prime, which is a trading and custody platform with over 13,000 institutional clients. To access crypto trading, institutions must be clients of both.

“Our institutional clients are more interested in digital-asset markets, and are focused on managing the operational lifecycles of these assets,” said Joseph Chalom (global head of strategic ecosystem partnerships, BlackRock). Aladdin connectivity will enable clients to manage bitcoin exposures in their existing portfolio management and trading workflows, allowing them to have a holistic view of risk across all asset classes.

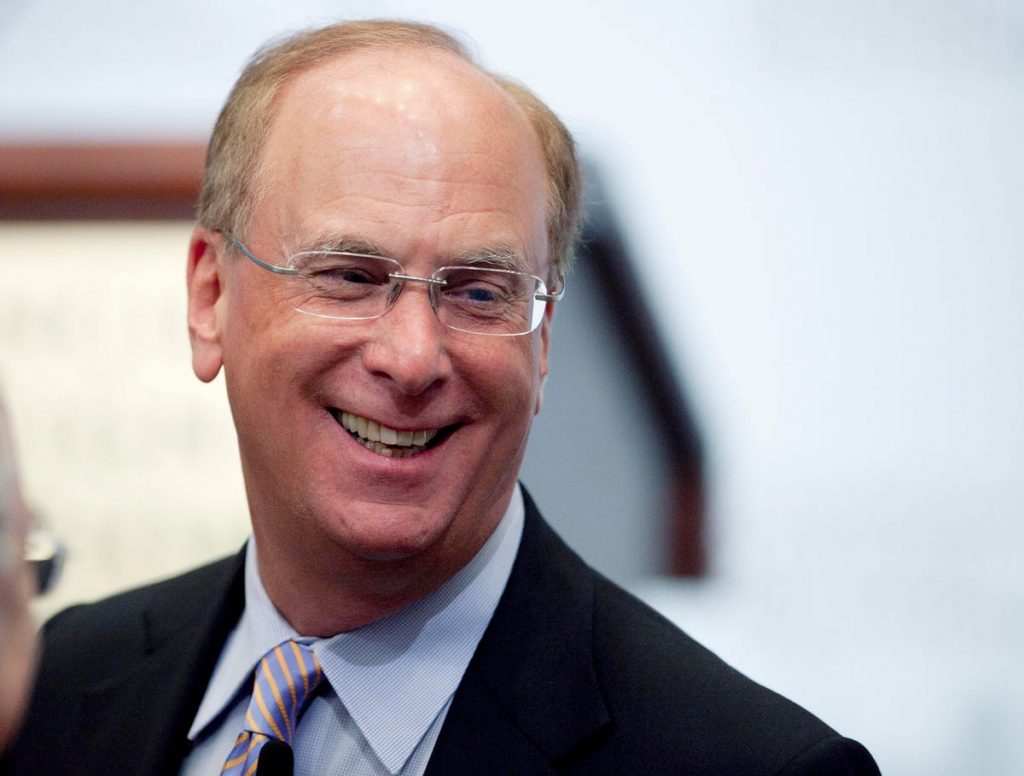

This tie-up represents a new step in BlackRock’s digital-assets journey and a slight reversal. BlackRock chairman Larry Fink called Bitcoin an “index of money laundering” five years ago.

But that all changed in March when Fink’s annual shareholder newsletter, which was published during the most intense fighting between Russia, Ukraine and Russia, suggested that the chaos caused by Moscow’s invasion could help accelerate the adoption digital currencies. This statement was interpreted by many in the industry as opening the door to further crypto involvement at the $10 billion firm, which is the largest asset manager in the world.

The company then launched a Blockchain and Tech Index (NYSE Arca : IBLC) the next month. This index tracks’results from an index that is composed of U.S. and foreign companies involved in the development and innovation of blockchain and other crypto technologies.

This partnership with Coinbase could not have been more timely. The stock, seen as a gauge of wider crypto sentiment, is currently down 57% in 2022 at the time this article was written. This is lower than Bitcoin which has fallen 52%. The stock rose as high as 40% today thanks to the news.

Analysts are anticipating another challenging quarter when Coinbase reports Q2 earnings on 8/9/2015. The exchange suffered a loss of $430 million in Q1. This was its first loss as a public company. It has also culled staff and frozen employment. Cowen Group, an investment firm, downgraded its estimates of the company’s performance in anticipation of the earnings. They expect a $246m loss on an Ebita basis. This is due to a decrease in retail transaction revenue, which fell to $693m from $797m a year ago. The consensus is for a $157million quarterly loss.

The Securities and Exchange Commission appears to have a direct interest in the company, as it recently charged an employee with insider trading for facilitating nine token listing. The SEC believed that the tokens under investigation were securities, implicit in their use of the term “insider trading”.

Coinbase insists that the hundreds of tokens it holds are not securities. According to current regulations, they cannot be listed. If this is proven to be the case, whether in court or through enforcement actions, Coinbase would likely have to delist some tokens or register at the SEC. This will allow it to be further enforced by the regulator.