Big Companies like, J P Morgan, Chase, Reddit, IBM, Microsoft, Amazon and Walmart they have all been buying up Ethereum over the recent weeks. It appears that at the same time that we have seen a number of addresses for the small holders, the retail investors, we are talking about people holding 0.1 or up to a hundred Ethereum or 0.01 Bitcoin or up to one Bitcoin. These addresses usually we think of them as okay, that’s just the retail guys we’ve seen that growing dramatically but at the same time that’s been happening, the big boys they’ve also been accumulating Ethereum.

Read:Bitcoin Era and learn How to earn and Invest.

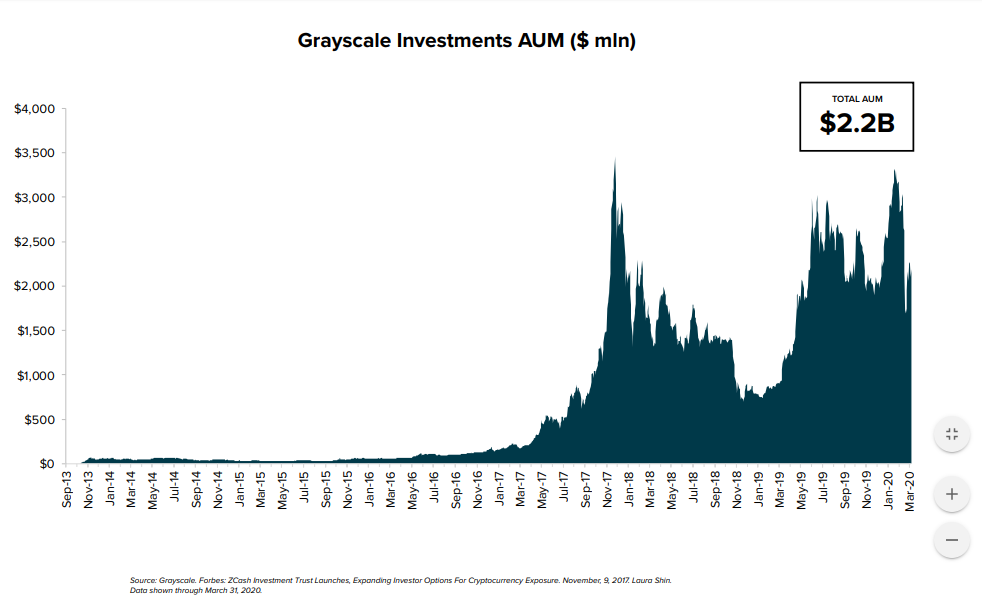

Greyscale also taking an active interest and buying up

It’s not just these big companies, of course, we have also seen Greyscale taking an active interest and buying up half of this year’s supply of Ethereum, but these wallets in particular, they are known to belong to these big companies just mentioned. They have been buying Ethereum.

This story is not just different from the story about Greyscale and their huge Ethereum buys because you know it’s big companies buying stuff but because these companies are directly buying and custody the asset themselves. When Grayscale buy, it holds onto it for you. These guys are buying it directly which means that aside from just looking for the price to go up they will likely be used in the asset for deploying contracts on the Ethereum network and of course, testing different features and different ways that they can use an open public network like Ethereum.

We will see many major companies running nodes in Eath 2.0 and why not get it, while it’s cheap now and speaking of Eath 2.0, we have a new clue about Eath 2.0 issuance from the man Vitalik himself . According to him the issuance of Ethereum 2.0 shall be reduced down to 2 million a year. This is less than half of the current annual issuance for ethereum which is around 4.7 million Eath a year.

Impact of Staking Ethereum.

So let’s recap quickly on Ethereum economics, moving forward, the issuance is being cut massively. Fees might be burned according to EW 159 and staking is coming. Remember 80% of the tesla supply is locked up for staking. What do you think is going to happen in the price of etherium, the second most popular and second most valued cryptocurrency when there is a huge surge in demand for staking ethereum?

Imagine if 80% of the supply of ethereum actually gets locked up for staking, another 10% maybe locked up for DeFi and newly-created ethereum being dropped by more than half. Ethereum or Ether particularly is going to become really rare, really quick, this could be the economic event that is actually way more important in the Bitcoin halving.

When we talk about the impact of the wider crypto economy, definitely something to keep in mind as we do move forward towards Ethereum 2.0 and the impact that staking is actually going to have on the second biggest crypto currency.