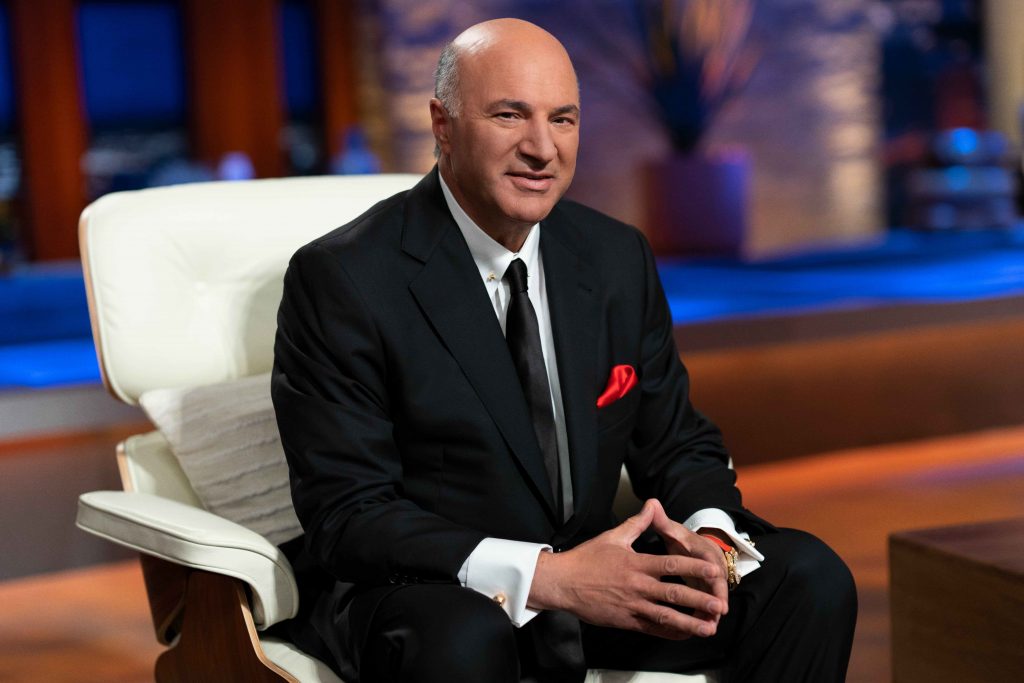

Kevin O’Leary, a ‘Shark Tank’ investor, is a strong believer in non-fungible tokens. He even believes they have a chance at becoming more than bitcoin.

O’Leary, O’Shares Investment Advisers chairman, stated that his belief in NFTs is based on the idea that they can prove ownership of real-world objects digitally, rather than using paper records.

NFTs are unique crypto tokens which serve to track the provenance, authenticity and origin of rare items like virtual art and sports memorabilia. There have been efforts for NFTs to be made available to physical assets.

O’Leary said Wednesday that there will be a lot more movement online in terms of authentication, insurance policies, and real estate transfer taxes over the next few year, making NFTs an even bigger and more fluid market than bitcoin.

“We’ll see what happens, but I’m placing that bet and investing on both sides.

NFTs were a relatively new phenomenon in 2020. However, not many people had heard of them. According to some estimates, more than $20 billion worth tokens were traded in 2021. A collage created by Beeple (real name Mike Winkelmann) was sold for record-breaking $69 million.

There are however concerns about the market’s sustainability. It has been compared to 2017’s initial coin offering frenzy, which saw many investors bet on unregulated token sales and get duped by them. There have been many scams and cases of stolen art that have occurred, which raised red flags for traders.

Canadian millionaire investor, the billionaire investor, has changed his mind on crypto over time. He used to call bitcoin garbage.

O’Leary stated that ‘it is a wasteful currency’ to CNBC’s “Squawk Box” in May 2019. ‘It’s worthless.’

O’Leary is now a fan of the space and sees it as a way to diversify from other assets, such as real estate, in times of rising inflation. O’Leary is especially bullish about ‘decentralized financing’, a trend that replicates traditional financial products through blockchain.

O’Leary revealed recently that ether is his largest position, although he also has some bitcoin, solana, and polygon.

About 40% of O’Leary’s new checks in the past six months were for cryptocurrency and blockchain-related ventures.

O’Leary stressed that crypto must be regulated. In order to protect consumers and prevent money laundering, regulators in the U.S. are trying to keep up with the developments in the crypto market.

O’Leary stated that different geopolitical areas have different policies regarding crypto. You must go to other jurisdictions that are more progressive.

Canada, his country of origin, was cited by him as an example jurisdiction that has been more forward-thinking than other countries on the topic of crypto.

Canada was the first country to approve an exchange-traded funds that give investors access to bitcoin. Although the U.S. Securities and Exchange Commission approved a bitcoin-linked ETF in the meantime, it tracks futures contracts and does not directly invest in bitcoin.

O’Leary also mentioned the United Arab Emirates (UAE) and Switzerland as countries that are open to crypto.

O’Leary stated that you must be positive and constructive. O’Leary stated that the floodgates of capital will open through pension and sovereign plans, which don’t yet exist.

Stablecoins, digital tokens that are tied to sovereign currencies such as and the dollar, are a particular concern for regulators. Economists are concerned that some notable stablecoins, such as USD Coin and tether, may not have sufficient reserves to back their claims of being backed with dollars.

O’Leary stated that ‘I believe [stablecoins] can also shine in the sunlight as a great method to get yield when it’s not possible to get any yield with cash.