There is 1 metal that is leaving all commodity — as well as Bitcoin — at the dust this season.

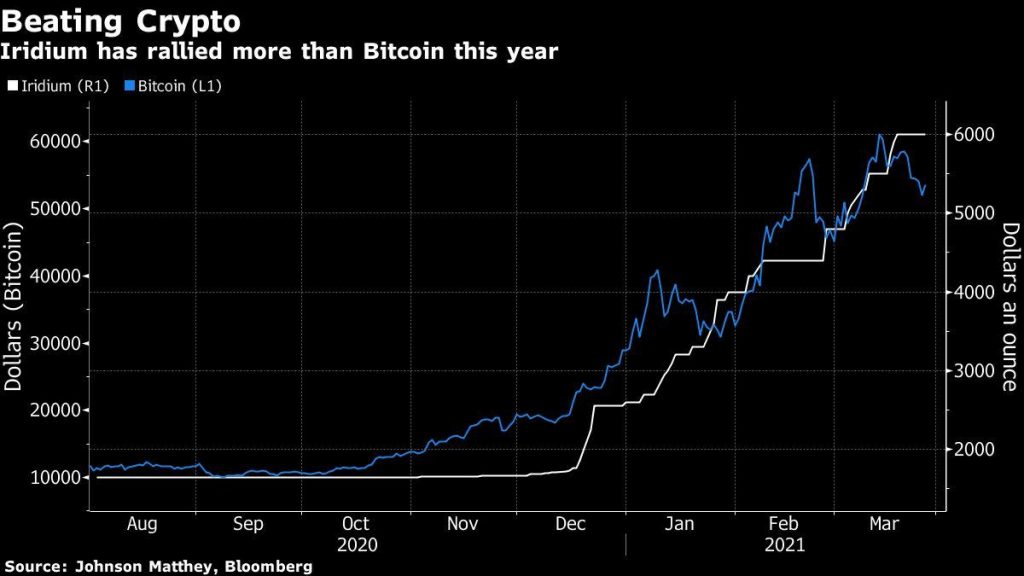

Iridium, among the most popular precious metals and hailed as a byproduct of gold and palladium, has soared 131% since the beginning of January, much surpassing Bitcoin’s 85 percent gain. It’s rallied on supply disruptions from the last year and increasing demand for usage in digital displays, refiner Heraeus Group stated.

Having a industry considerably more compact compared to its more famous warrior alloys, manufacturing problems could have a large effect on costs. Betting on it’s tough also, as requirement is dominated by industrial users. Iridium is not traded to a bourse or via exchange-traded capital, retail buyers have been confined to ingots out of a small number of dealers as well as the few significant investors working inside go directly to manufacturers.

‘The direct time on the side is too lengthy to raise distribution in a timely manner,’ said Jay Tatuma portfolio manager in Valent Asset Management. ‘The sole near-term alternative is greater costs to have individuals to market their present holdings’

This makes it greater than 3 times more costly than gold.

Section of iridium’s allure comes in the restricted investment in creation of silver, that is mostly utilized in autocatalysts to suppress emissions, while some investors consider possible gains in platinum demand from hydrogen technology against a change to electric vehicles.

The prognosis for tight distribution also helped push costs of additional platinum-group metals. Palladium is all about 9% under an all-time large, rhodium attained a record $29,800 a ounce per week plus ruthenium has shrunk into a nearly 13-year high.